My co-worker the computer: How AI is helping the furniture industry

The market for AI in robotics is growing rapidly. Current analyses suggest that global volumes will roughly triple by the end of the decade, with annual growth rates of around 30 per cent. At the same time, studies on the wood and furniture industry show that robots and AI are no longer an experiment, but part of everyday operations – especially for tasks such as sanding, lacquering, pick-and-place, gluing and assembly, as well as the evaluation of production and quality data.

There are good reasons for this. Pressure is particularly high in the volume segment. Many companies are simultaneously struggling with staff shortages, an ever-increasing number of product ranges, tight delivery expectations and a growing bundle of regulations. The new EU Ecodesign Regulation for sustainable products and the planned digital product passport will require the industry to provide much greater transparency on materials, origin, repairability and end-of-life routes. Those who consider these developments together and invest early in digital product development, AI-supported processes and clean data structures can test their first solutions in dialogue with retailers and buying groups – and, for example, refine them in a very hands-on setting with decision-makers from DACH retail at imm cologne.

Product design reimagined: individualisation thanks to AI

In product development, the influence of AI is particularly evident. Generative systems can create dozens or even hundreds of variants of a piece of furniture in a short time – for example chair frames, table substructures or shelving systems. These variants are automatically simulated and assessed in terms of stability, material usage and production effort. A recent overview of robotics and AI in the furniture industry2 describes exactly this trend: AI-supported workflows help to reduce material consumption, stabilise processes and increase productivity without worsening working conditions. For manufacturers in the mid- and low-price segment, this means faster development cycles, variants that are easier to calculate and fewer costly misdevelopments.

Things become even more interesting when these systems are combined with mass-customisation approaches. Customers choose dimensions, fronts, colours or internal layouts while, in the background, an AI checks whether the configuration is technically feasible, generates bills of materials and CNC data (Computerized Numerical Control Data) and calculates realistic delivery times. Research into the furniture industry emphasises that without such intelligent systems it is almost impossible to manage the growing variety of variants, especially when series production and batch size one run in parallel.

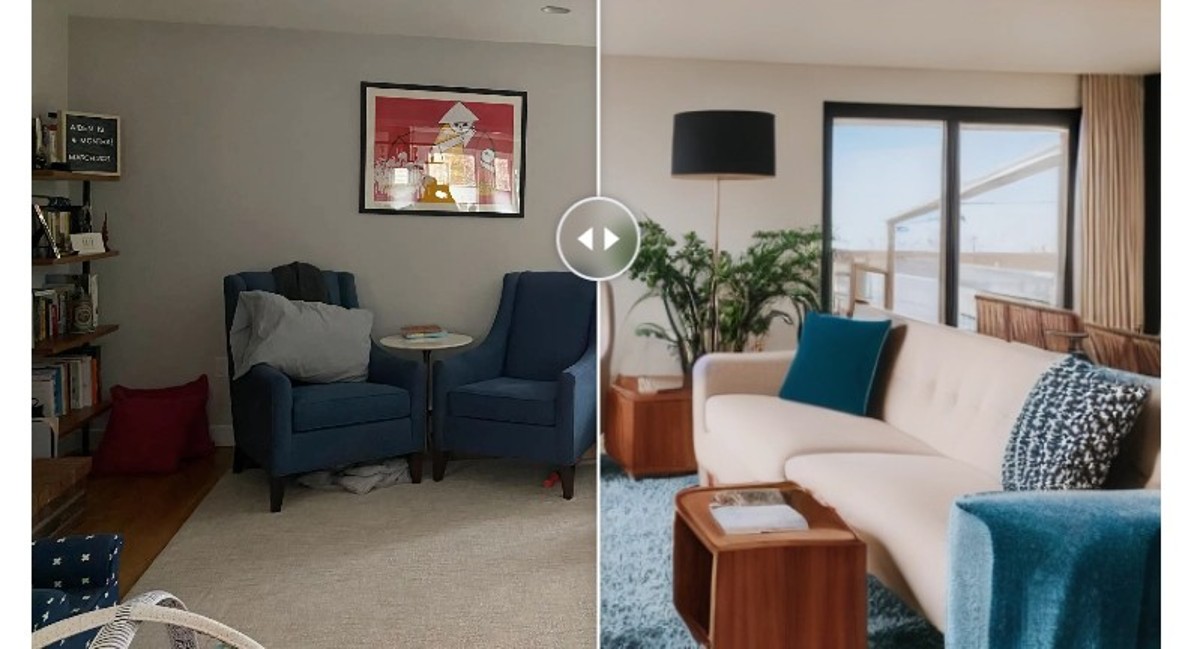

“Decorify” makes it possible to realistically visualise home design dreams in your own rooms Credit: Wayfair

On the consumer side, new experiences are emerging at the same time. Online retailers such as Wayfair have shown with the tool “Decorify” how generative AI can turn a simple photo of a real living space into photorealistic, newly furnished variants – including product recommendations that can be bought directly from the existing range. Platforms such as Planner 5D or specialised AI room planners allow users to virtually test rooms with different furniture and styles within minutes, without any professional planning experience at all. For manufacturers and retailers, the decisive factor is that product data are cleanly structured, can be planned digitally and are AI-ready. Those who achieve this can participate in these customer journeys even without building a large in-house software team.

Robotics on the shop floor: cobots and driverless transport systems

In factories, robots are moving ever closer to the furniture. In many companies they take over physically demanding, monotonous and hazardous tasks. Studies show that sanding, lacquering, gluing, assembly and pick-and-place are increasingly automated – with measurable effects on quality, scrap rates and occupational safety.

A vivid example is provided by Serbian solid wood furniture manufacturer Enterijer Mesički. Together with RoboDK and FANUC, the company has set up a robot cell in which chair and table components are milled and sanded. The machine takes over the repetitive movements with high repeat accuracy, while skilled workers focus more on surface finishing, special orders and quality assurance. The result is more stable processes, less waste and production that can grow despite a shortage of skilled labour.

Mobile industrial robots make furniture production autonomous, efficient, flexible and safe. Credit: KUKA/Formetal

German company Alfons Venjakob GmbH & Co. KG takes the next step in intralogistics and uses driverless transport systems from ek robotics. In narrow aisles and with a high diversity of variants, the vehicles move furniture parts and assemblies through the plant automatically. In another project, KUKA and Italian specialist Formetal combine autonomous mobile robots with a palletising robot that automatically stacks and moves heavy wooden panels. Such solutions reduce the physical strain on staff, increase process stability and shorten cycle times – and they also work in medium-sized structures, provided that components and layouts are designed with robotics in mind at an early stage.

This is precisely where a trade fair stage can help. Manufacturers whose ranges can be produced efficiently in automated processes and whose constructions are based on standardised components can use imm cologne to demonstrate convincingly that attractive design, reliable delivery capability and economical production in the volume market do not contradict each other.

AI as a new colleague in customer service

AI is becoming a team member not only in production but also in customer contact. The pan-European furniture retailer mömax, for example, uses a generative AI chatbot developed together with iAdvize that answers questions on the range, orders and deliveries around the clock. According to the case study, the solution achieves an automation rate of around 71 per cent, meaning a very large proportion of enquiries are resolved entirely digitally, and records a conversion rate of 13 per cent after bot interaction.

Another example comes from Australia. Online retailer Temple & Webster reports record sales and at the same time notes that more than 80 per cent of customer interactions are now automated and support costs have fallen by around 60 per cent. What matters here is not the individual figure, but the pattern behind it: AI handles frequent standard queries and simple advisory cases, while people focus on complex projects, complaints and planning.

For manufacturers, this is relevant because retail partners are increasingly looking for ranges that integrate seamlessly into such digital service processes – from consistent product data and clear availability information through to services around spare parts and after-sales.

Soon to be required: the digital product passport for greater transparency Credit: Generated with Canva’s AI tool

The digital product passport: data foundation for AI and circularity

In parallel with AI and robotics, the digital product passport is creating a new “data layer” for the industry. The DPP is part of the EU Ecodesign Regulation for sustainable products and is intended to consolidate data on components, materials, repairability, certifications and end-of-life options. According to current information, the furniture industry will be among the first sectors affected; in Germany alone, the Association of the German Furniture Industry estimates that around 16,000 companies in the interiors sector will have to implement DPP obligations in the medium term.

Furniture-X, a consortium founded in Cologne in 2024, is working on common standards and processes for DPP data specifically for the furniture sector in order to avoid isolated solutions. International projects such as the Swedish research alliance APPEND or the collaboration between Johanson Design and Sigma Technology show how these passports can be implemented technically: a content management system automatically pulls product data from the ERP system, generates digital product passports from them and makes them available via QR codes on the product and via interfaces for retail and service.

From an AI perspective, these passports are genuine treasure troves. Only once information is structured can algorithms perform meaningful analyses – for example on the CO₂ and resource footprints of entire ranges, on the likelihood that specific product types will need repair, or on the potential for take-back and refurbishment models. Companies that make their data DPP-ready today are laying the foundations for future digital services in retail, after-sales and second-hand or contract channels.

What companies should do now – and the role Cologne plays

For manufacturers in the mid- and low-price segment, there is no way around thinking about AI, robotics and data strategy together. It is about quickly making key bestsellers AI- and DPP-ready, systematically identifying areas where cobots or driverless transport systems could offer tangible relief and preparing product data so that they work in configurators, room planners and service bots.

Taking part in imm cologne offers a very practical advantage in this transformation process. Companies can use the event not only to showcase their new collections, but also to present their digital solutions, to test – in direct conversations with buyers from bricks-and-mortar retail, buying groups and e-commerce players – how well their data and processes already connect, and to identify which investments make most sense next. Those who set the course today will not only have attractive furniture in their range tomorrow, but also robust answers to the question of how to serve volume markets profitably under the conditions of AI, robotics and strict sustainability regulation.

Save the date: 20-23 January 2026 - imm cologne, Cologne

More information & exhibitor list:

www.imm-cologne.com

Subscribe to the newsletter and never miss a trend!

StartUs Insights –

Artificial Intelligence and Robotics Report 2025 / Global Industry Analysts –

Artificial Intelligence (AI) Robots – Global Strategic Business Report / The Business Research Company –

Artificial Intelligence (AI) Robots Global Market Report

ScienceDirect –

A survey on recent trends in robotics and artificial intelligence in the furniture industry